Late fee assessment is controlled by settings on the Account Profile.

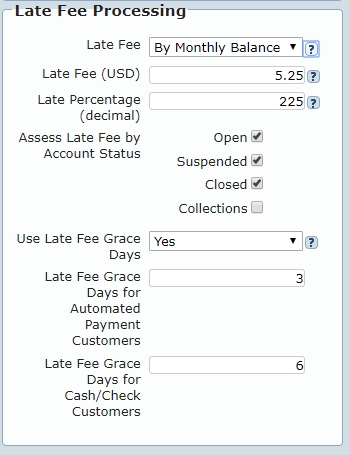

Timing and amount of the late fee will depend on the Late Fee

Processing settings.

Late Fee By Monthly Balance

When Late Fee is set to By Monthly Balance,

late fees are assessed once a month. What day during the month is controlled by

User Late Fee Grace Days:

- No

- Late fees are assessed the day the monthly Billing Statement is created. This is true regardless of whether the customer receives Invoices or Billing Statements.

Example

Assume a customer has their automated monthly Billing Statement created on the first of the month. On the first of the month the late fee is assessed for overdue amounts. No consideration is given when the amounts became overdue.- Yes

- Late fees are assessed on the day after the monthly Billing Statement due date plus the number of Late Fee Grace Days based on the customers payment method.

Example

Assume a customer has their automated monthly Billing Statement created on the first of the month with a due date the 15th of the month. Also assume the customer pays by credit card and Late Fee Grace Days for Automated Payment Customers is 10. On the 26 of the month (day after the due date of 15th + 10 days) the late fee is assessed for overdue amounts.Late Fee By Invoice

When Late Fee is set to By Invoice, late fee are assessed once a month per Invoice. What day during the month is controlled by User Late Fee Grace Days:

- No

- Late fees are assessed the day after the Invoice due date and every month thereafter. This is true regardless of whether the customer receives Invoices or Billing Statements.

Example

Assume a customer has an Invoice created on the first of the month with a due date of the 25th. On the 26th of the month the late fee is assessed for overdue amounts belonging to the Invoice.- Yes

- Late fees are assessed on the day after the Invoice due date plus the number of Late Fee Grace Days based on the customers payment method.

Example

Assume a customer has an Invoice created on the first of the month with a due date the 15th of the month. Also assume the customer pays by credit card and Late Fee Grace Days for Automated Payment Customers is 10. On the 26 of the month (day after the due date of 15th + 10 days) the late fee is assessed for overdue amounts.Fee Amount

The amount of a Late Fee depends on the following settings:

- Late Fees setting on the Account. If set to No, no automated Late Fees will be assessed.

- Overdue Minimum Amount specified in the Overdue Processing section of the Account Profile. If the total overdue amount for the Account under consideration is less than the Overdue Minimum Amount, no automated Late Fees will be assessed.

- Late Fee and Late Percentage in the Late Fee Processing section of the Account Profile. The overdue amount will be multiplied by the Late Percentage and the greater of the result and Late Fee will be used as the late fee. The Late Fee provides a late fee "floor".

Other

Whether or not taxes are assessed on late fees is configured through the Virtual Company setting Taxable under Fees.

Whether or not late fees are assessed on late fees being late is configured through the Virtual Company setting Assess Late Fees on Late Fees under Fees.