Taxes are charged based on a P Code derived from the User’s location and the T/S Pair of the item or service.

- To begin Set Avalara Parameters .

- Configure Avalara T/S Pairs for each package or service that needs to be assessed a tax.

- Set Virtual Company Parameters.

- Set Place Codes for Users.

-

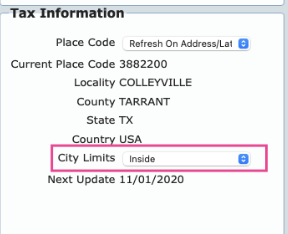

City taxes can be affected if a User is Inside or Outside the City Limits. The

default comes from Avalara but can be overridden on the User. Make changes as

necessary.

- Update Pending Transactions.

- Review Setup for Accounts for Avalara and Setup an Avalara Tax Exemption to complete your setup.